Guest post by Dave Kilkenny with Finance of American Mortgage.

The housing market seems to be shifting to become more balanced. While still technically a “seller’s

market”, there has been an increase in price reductions. Nationwide, 20% of the homes listed have had

a price reduction. One of the main factors for the shift is the dramatic increase of mortgage rates that

started in January and seem to have peaked out here in the Pacific Northwest in June/July. This increase has had two effects on

buyers: budget and qualification. The same buyers that have been shopping for the last 2 years are

finding themselves in “payment shock”. And while they have less competition when a home comes on

the market, if the payment does not work for their budget, what can be done?

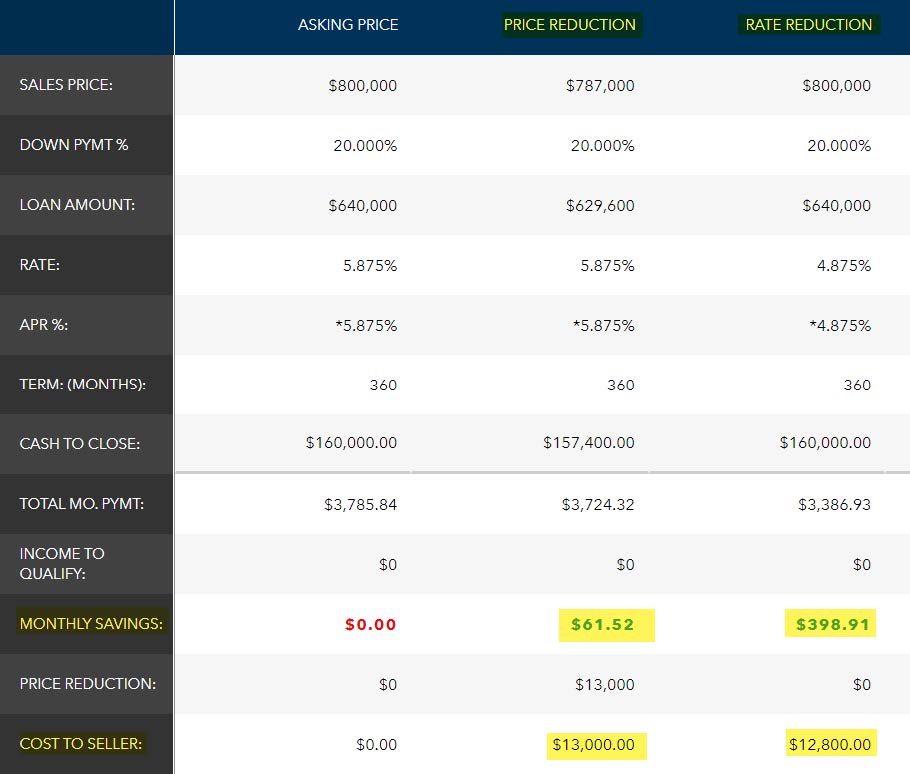

The Seller Buydown is a great alternative to a price reduction. The lender will allow the seller to use a portion of their proceeds as a concession to cover closing costs and/or buy down the interest rate for the buyer. For example, instead of lowering the sales price by $13,000 (resulting in a minimal reduction of the buyer’s monthly payment), they could instead pay to buydown the rate by ¾% – 1%, resulting in a much larger monthly payment reduction. And the monthly payment is what the buyer is most concerned about in this market, as it has the biggest impact on what they can afford.

The Seller Buydown can be initiated by either the seller, who offers this in lieu of a price reduction, or the buyer who offers full price and requests the Seller Buydown. In the below example, the Seller Buydown which costs $13,000 saves the buyer $399 on their monthly payment, while a $13,000 price reduction only saves $62 per month:

To help our customers leverage this powerful tool, Evergreen Homes is offering a rate buydown to qualified buyers through our preferred lender, Dave Kilkenny at Finance of America Mortgage, on specific homes to help reduce your monthly payment. Call Chris at 360.624.3116 to discuss the details.